The Wisconsin workers’ compensation hospital fee schedule, established under new state law, will limit how hospitals bill for treating injured workers beginning no later than July 1, 2027. While the goal is to bring predictability and cost control to hospital billing, the law comes with important nuances that both medical providers and injured workers should understand.

What Is the Wisconsin Workers’ Compensation Hospital Fee Schedule?

Under Wis. Stat. § 102.423, the Department of Workforce Development (DWD) must create and implement a fee schedule that sets a maximum amount hospitals can charge for medical treatment in workers’ compensation cases. Here’s how the system will function:

-

The state will be divided into five regions based on geography and economic data.

-

For each region, the DWD will calculate the 75th percentile of in-network commercial health insurance rates (excluding Medicare and Medicaid).

-

Hospitals will be allowed to charge no more than 120% of that 75th percentile amount for any given service.

-

The finalized fee schedule will be published on the DWD’s website and updated annually.

When Will the Wisconsin Workers’ Compensation Hospital Fee Schedule Take Effect?

The DWD must complete and publish the fee schedule by July 1, 2027. Once published, it will apply only to treatment provided on or after that date. Until then, existing billing practices remain in place.

Timely Payment Requirements for Insurers

The fee schedule only applies if insurers or self-insured employers pay hospital bills on time. If they don’t, the schedule becomes irrelevant, and hospitals may revert to full billing rates.

Here are the deadlines:

-

Bills under $65,000 must be paid within 60 days of receiving the bill or supporting records.

-

Bills $65,000 or more must be paid within 90 days.

-

Insurers may request 30-day extensions while reviewing compensability, subject to DWD approval.

-

If an extension is denied, payment must be made within 14 days.

-

Hospitals must respond to documentation requests within 10 days, when practicable.

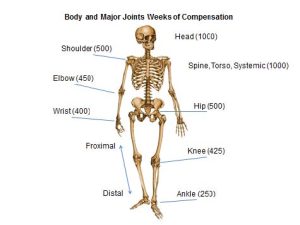

Permanent Partial Disability Chart Wisconsin workers’ compensation benefits

Not All Providers Are Affected by the Wisconsin workers’ compensation hospital fee schedule

The law only applies to entities that qualify as a “hospital” under Wis. Stat. § 50.33(2). To meet this definition, a facility must:

-

Provide care to three or more nonrelated individuals, and

-

Regularly offer:

-

Diagnostic X-ray services,

-

Clinical laboratory services, and

-

Treatment facilities for surgery, obstetrical care, or other definitive medical care.

-

Notably, the law does not require simultaneous treatment of three patients. It’s enough if the facility routinely treats multiple patients across a typical workday or shift.

Providers not covered by the fee schedule typically include:

-

Chiropractic clinics

-

Standalone physical therapy centers

-

Pain management facilities

-

Independent outpatient diagnostic centers

How Providers Can Confirm They’re Not Subject to the Wisconsin workers’ compensation hospital fee schedule

If you operate a clinic or outpatient practice and want to avoid misclassification under this law, follow these best practices:

-

Check your licensure: If your facility is not licensed as a hospital under DHS Chapter 124 or Wis. Stat. § 50.33, that’s a strong indicator you’re exempt.

-

Evaluate your services: Avoid providing services such as surgery, obstetrical care, clinical lab testing, or X-ray diagnostics on a regular basis.

-

Clarify your care model: If your practice sees patients individually and does not operate like a hospital, that matters—even if you see several patients a day.

-

Avoid hospital branding: Don’t refer to your facility as a “hospital” in any public-facing materials.

-

Maintain clear documentation: Keep evidence of your licensure, services, and internal classification on hand for billing disputes.

-

Respond quickly to disputes: If an insurer applies the fee cap to your bill improperly, respond in writing and cite Wis. Stat. § 50.33 and § 102.423.

-

Stay up to date: The DWD is expected to release administrative rules before implementation—monitor for updates.

What Injured Workers Should Know

As attorneys who exclusively represent injured workers, we’re keeping a close eye on how this law may impact access to care. While the fee schedule is designed to contain costs, it’s important that it doesn’t restrict treatment options for those recovering from work injuries.

Here are a few takeaways for workers:

-

If the insurer pays the bill on time and your provider is covered by the schedule, you cannot be balance billed for any amount above the fee cap.

-

Your treatment rights remain unchanged. You still have the right to choose your doctor and get treatment that’s reasonably necessary for your recovery.

-

Not all providers are subject to the schedule, so claims involving chiropractors or therapy centers may still involve traditional billing disputes.

-

If the insurer delays payment, hospitals can bill more than the capped amount, which may affect settlement discussions.

Learn More

- ➡️ Read our Wisconsin Work Comp Medical Treatment Guide

- ➡️ Visit our Injured Worker Resource Center

- ➡️ Visit our YouTube Channel for 60 Second videos on how to protect yourself

Have Questions About Your Rights or Billing?

Whether you’re a provider trying to understand your responsibilities or a worker concerned about medical charges, Axis Legal is here to help.

📞 Call us at (414) 414-4814

🌐 Visit theaxislegal.com

Axis Legal – Centered on Your Recovery.